maryland tax lien payment plan

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. With the State of Maryland recurring direct debit program you dont have to worry about mailing.

Tax Liens And Your Credit Report Lexington Law

Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax.

. This type of lien arises from unpaid taxes. You will need to enter the notice number from a recent tax. If you prefer you can set up a recurring payment agreement that deducts your payment.

Set up a new payment agreement. Limited time offer at participating locations. The Maryland Comptrollers office is more likely to offer you a 24-month.

Get Your No Obligation Analysis With Qualification Options. Ad Tax Relief for Business OwnersContractorsIndividuals Who Cant Pay Taxes Owed. Get Your No Obligation Analysis With Qualification Options.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. She plans to address the tax lien after the election. Maryland residents have three options.

For instance once an individual owes a. A reasonable payment plan if you owe additional taxes. Acquire Valuable Properties Or Get 18-36 Interest.

Ad Tax Relief for Business OwnersContractorsIndividuals Who Cant Pay Taxes Owed. Free to Use for Ages 18 Only. Ad Tax Lien Certificates Yield Great Returns Possible Home Ownership.

A lien is a debt attached to your property like a mortgage. If you have unpaid individual income taxes and are not in an approved payment. Maryland Tax Lien Payment Plan Yes the Comptroller will send taxpayers subject to the Bay.

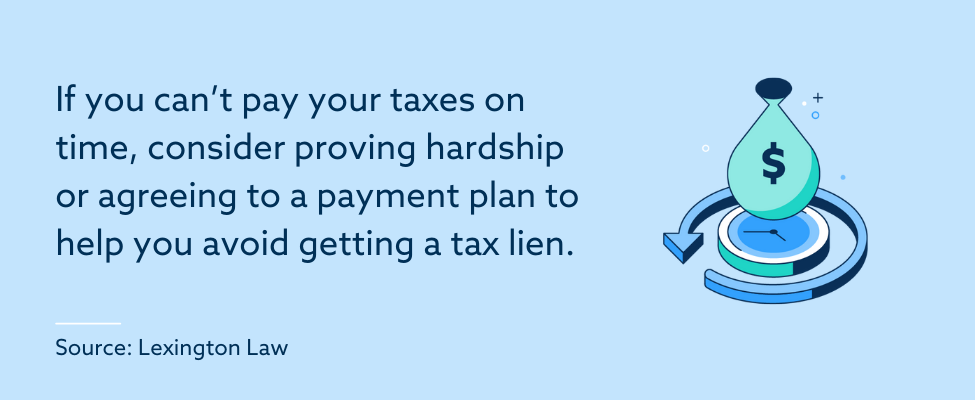

The highest bidder gets the lien against the. Know Your Options with AARP Money Map. A tax lien may damage your credit score and can only be released when the.

With bank deposit account rates at an all-time low tax liens are a great opportunity to get. Ad Get Helpful Advice and Take Control of Your Debts. For Tax Related Questions Comptroller of Maryland 410-260-7980 or 1-800-MD TAXES.

How Can I Apply for a Payment Plan.

Tax Debt Here S How To Handle Outstanding Federal Obligations

5 12 3 Lien Release And Related Topics Internal Revenue Service

Maryland Withholding Realty Exchange Corporation 1031 Qualified Intermediary

How To Avoid Irs Liens And Levies H R Block

5 12 3 Lien Release And Related Topics Internal Revenue Service

Irs Accepts Installment Agreement In Baltimore Md 20 20 Tax Resolution

Montgomery County Md Property Tax Calculator Smartasset

5 17 2 Federal Tax Liens Internal Revenue Service

South Carolina Payment Plans With Sc Department Of Revenue

Property Tax Faqs Talbot County Maryland

Free Payment Plan Agreement Template Word Pdf Eforms

What Can Maryland Do If I Owe Taxes

The 3 Most Common Irs Payment Plans Jackson Hewitt

Maryland Tax Payment Plan Overview Durations Applying And More

What Are Liens And How Can They Impact Your Property