j-51 tax abatement phase out

The J-51 abatement is just a lovely. The J-51 tax incentive is an as-of-right tax exemption and abatement for residential rehabilitation or conversion to multiple dwellings.

Opinion Let The J 51 Property Tax Abatement Die Too

The j51 tax incentive program is designed for.

. The benefit varies depending on the buildings location and the type of improvements. Enactment of a nuisance abatement law by a town within the county provided that the function has not been transferred by the town to the county level under the provisions of a county. The exemption will last for a period of fourteen years with 100 exemption for ten years followed by a 20 phase-out in each of the succeeding four years.

Whether you qualify for the. Can provide tax advantages andor tax abatement provided that easement is long term or perpetual. Lease entered into during the tax benefit period.

The J-51 Program has. The J-51 tax abatement program was implemented in 1955 as a way to encourage building owners to install hot water plumbing in their properties. Horton is building new homes in communities throughout New Jersey.

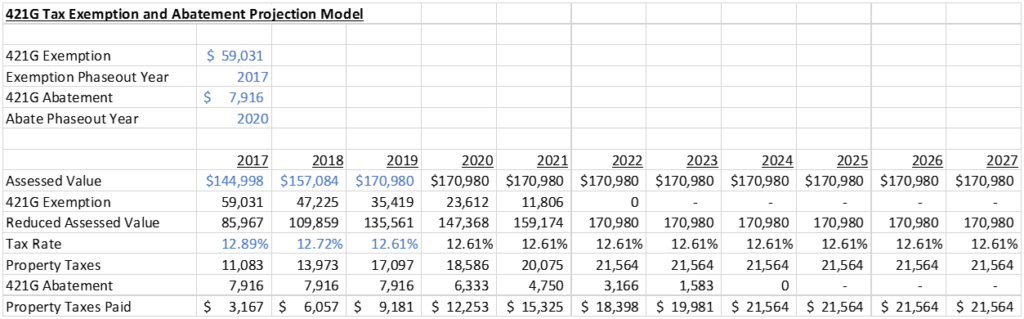

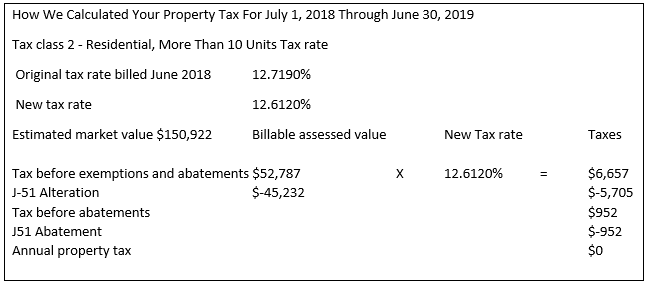

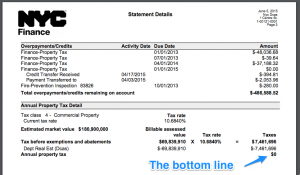

The post-construction tax benefits phase out over time based on a set schedule and the property becomes fully taxable upon expiration of the abatement. Tax Abatement The J51 abatement. The 3-member Board of Assessors appointed by the Mayor ensures the accuracy of the assessing database used for ad valorem taxation annually determines the new growth.

This is even if their rent was above the de-stabilization threshold which used to be 2000month was increased to 2500 in 2012 and is now 2700month. In other words the J 51 program comes to an end whenever the total amount of the J-51 lifetime abatement is exhausted or the maximum 20-year time limit ends. Example A four unit building 100 Main St was placed under rent regulation upon the receipt of J-51 tax benefits on January 1 2009 for a.

The J51 exemption portion effectively freezes a buildings increase in assessed value resulting from the alteration or improvement of a building or structure except insofar as. J-51 is less well. J-51 Tax Abatement Phase Out.

Fee Simple Acquisition Fair Market Value - Outright purchase of full title to land at. The exemption will last for a period of fourteen years with 100 exemption for ten years followed by a 20 phase-out in each of the succeeding four years. See all the home floor plans houses under construction and move-in ready homes available across New Jersey.

Nyc Tax Abatements Guide 421a J 51 And More Makingnyc Home

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

J 51 Tax Abatement Definition Explanations Propertyclub

New York City Property Taxes Cbcny

The Return Of The Tax Abatement In New York City

What Is The 421g Tax Abatement In Nyc Hauseit

J 51 Tax Abatement For Co Ops And Condos Is Stuck In Limbo Habitat Magazine New York S Co Op And Condo Community

Co Op And Condo Advocates Push For J 51 Tax Break Renewal Habitat Magazine New York S Co Op And Condo Community

Buying An Apartment With A J 51 Tax Abatement Hauseit

New York Allows J 51 Tax Exemption For Buildings To Expire

J 51 Tax Abatement In Nyc History Benefits Drawback And More

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Buying An Apartment With A J 51 Tax Abatement In Nyc Youtube

Buying An Apartment With A J 51 Tax Abatement In Nyc Youtube

City Council To Revive J 51 Tax Break For Apartment Buildings

J 51 Tax Abatement In Nyc History Benefits Drawback And More

J 51 Tax Abatement In Nyc History Benefits Drawback And More

City Council Set To Consider Extending J 51 Tax Breaks Habitat Magazine New York S Co Op And Condo Community

What Tax Benefits For Investment Properties In Nyc Nestapple